Branch of the Future: Using Edge Computing to Modernize ATM, KYC, and CX

How banks are rebuilding physical touchpoints with real-time intelligence, resilience, and trust.

The Branch Is Not Dead. It Is Becoming Real-Time.

For years, banks optimized digital channels while physical branches and ATMs quietly aged. Then two things happened. Customer expectations jumped to “instant” everywhere, and fraud plus compliance pressure intensified. Suddenly, the weakest links were the places farthest from the cloud.

A cash withdrawal that stalls. A KYC check that takes minutes. A queue that grows because systems wait on a central decision. These are not UX problems alone. They are latency and locality problems.

The answer many banks are adopting is edge computing at the branch. Not to replace core systems, but to move time-critical decisions closer to where customers actually interact.

Why Cloud-Only Breaks Down in Branches and ATMs

Branches and ATMs live in the real world. Networks fluctuate. Backhaul links fail. Peak hours are unpredictable. Yet cloud-only architectures assume stable connectivity and centralized processing.

This creates four recurring issues.

First, latency. Authentication, fraud checks, and limits validation often require multiple cloud round-trips, pushing response times beyond what customers tolerate.

Second, resilience. When connectivity degrades, branches lose capability rather than gracefully degrading.

Third, compliance. Many regulators expect sensitive identity and biometric data to be processed locally or regionally.

Fourth, cost. Constantly streaming video, logs, and telemetry from thousands of branches to the cloud is expensive and unnecessary.

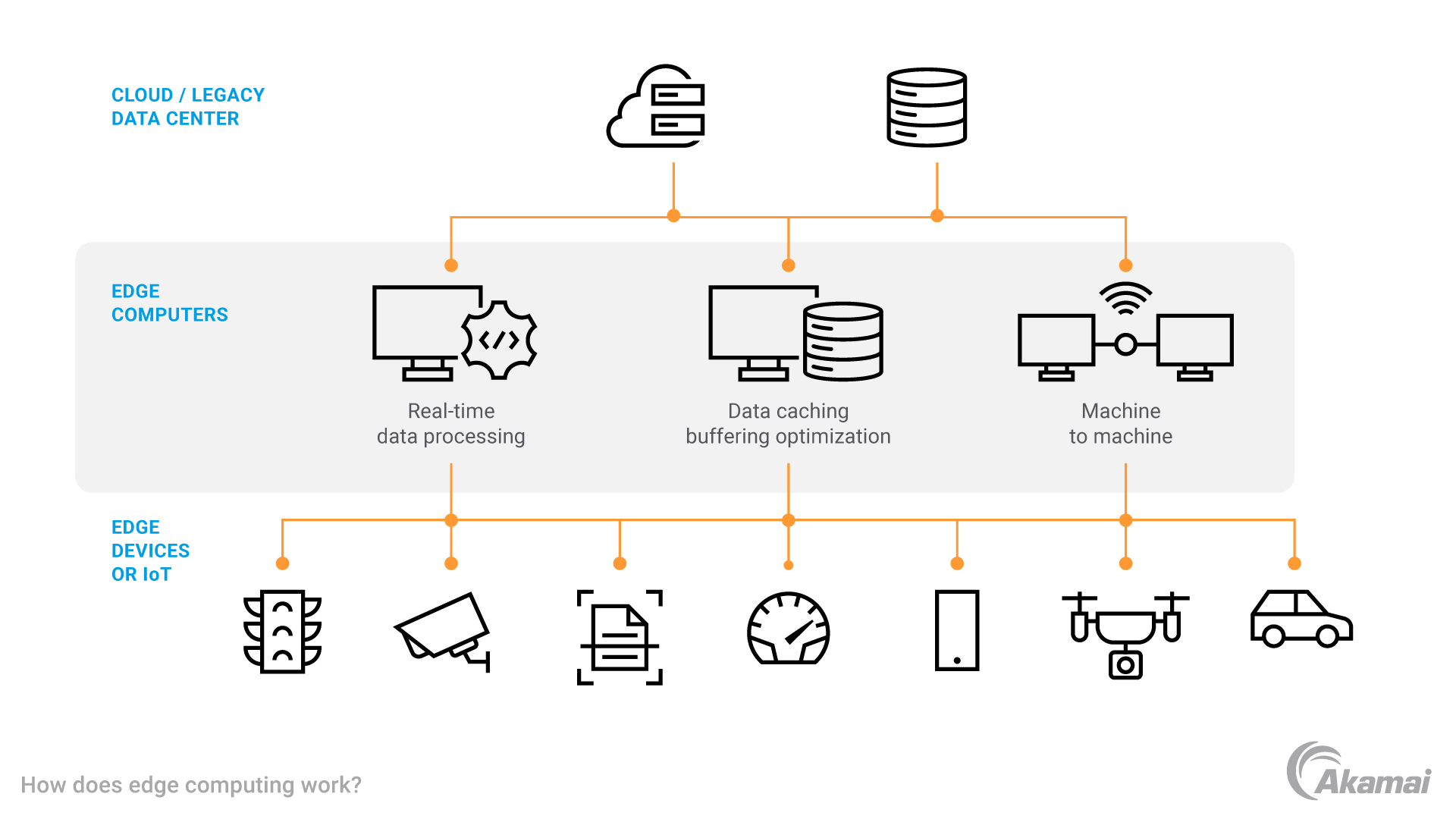

Edge computing addresses all four by putting decision-making power inside the branch or ATM network.

What “Edge at the Branch” Actually Means

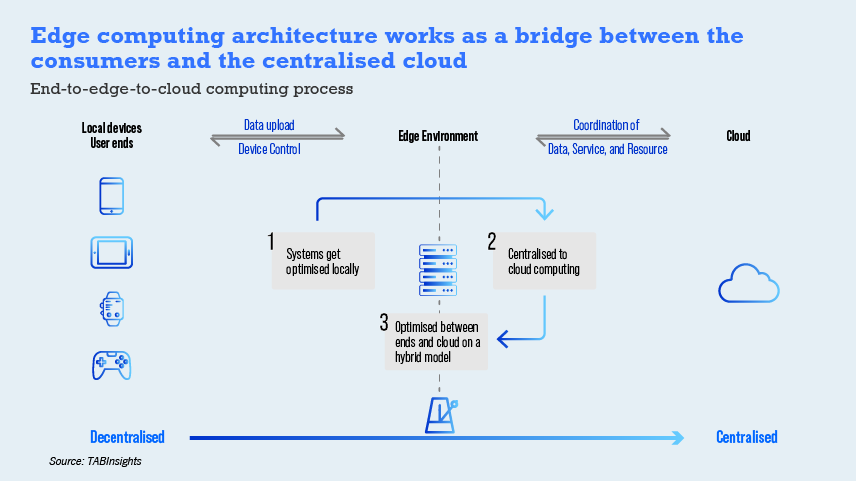

Edge computing in banking does not mean running the core banking system in every branch. It means introducing a local intelligence layer that can act independently when needed and synchronize with the cloud when possible.

Typical responsibilities of the branch edge include identity validation, fraud scoring, biometric matching, device health checks, queue management logic, and local caching of customer and policy data. The cloud remains the system of record, model trainer, and analytics engine.

The relationship is cooperative. The edge executes. The cloud coordinates.

Modernizing ATMs With Edge Intelligence

ATMs are one of the clearest edge use cases in banking.

Traditionally, an ATM transaction involves device checks, card validation, PIN verification, fraud screening, limits evaluation, and logging, many of which depend on central systems. Each dependency adds delay and fragility.

With edge computing, banks move several steps locally. The ATM or a nearby regional edge node can validate device integrity, enforce withdrawal limits, check recent velocity, and score basic fraud risk in milliseconds. Only higher-risk or exceptional cases require escalation.

Banks that have adopted this pattern report sub-100ms authorization times for standard withdrawals and far fewer “transaction timed out” errors during peak hours. Just as important, ATMs continue operating in a restricted but functional mode during temporary network outages.

Edge-Driven KYC and Identity Verification

KYC is another area where centralization hurts experience.

Video KYC, document verification, and biometric checks generate heavy data and require fast feedback. Sending every frame or scan to the cloud introduces delay and raises data residency concerns.

At the edge, branches can perform initial document validation, face matching, liveness detection, and quality checks locally. Only metadata and final verification results are synchronized with central systems.

This approach shortens onboarding time dramatically. Banks have reduced in-branch KYC flows from several minutes to under one minute while improving fraud detection. It also simplifies compliance because sensitive biometric data does not need to leave the country or region.

Customer Experience That Reacts in Real Time

Edge computing enables branches to become context-aware.

Queue management systems can react instantly to foot traffic. Teller systems can pre-load customer profiles as soon as a card or app check-in is detected. Digital signage can adjust content based on time of day, customer segment, or current wait times.

One large retail bank deployed edge-powered queue optimization across urban branches. By making decisions locally instead of querying central systems, average wait times dropped by over 20 percent during peak periods. The change required no redesign of core applications, only smarter placement of logic.

Security and Zero-Trust at the Branch Edge

Branches and ATMs are physically exposed environments. Edge systems must assume tampering attempts and hostile networks.

Modern branch edge architectures use secure boot, signed software, encrypted storage, and mutual TLS for all communication. Every ATM, kiosk, and edge service has its own identity. Policies define exactly what each component is allowed to do, even when offline.

If an edge node is compromised, segmentation ensures the blast radius is limited to that location. Logs are stored locally and synchronized later for forensic analysis. Security becomes stronger, not weaker, because trust decisions happen closer to reality.

Operating at Scale Without Losing Control

A common fear is edge sprawl. Thousands of branches sound like an operational nightmare.

In practice, banks manage this with centralized orchestration and local autonomy. Policies, models, and configurations are defined centrally and deployed as signed packages. Edge nodes report health, metrics, and drift status back to the cloud when connectivity allows.

Updates roll out gradually using canary deployments by region or branch type. If a change degrades performance or accuracy, rollback is immediate and local.

This model mirrors how banks already manage ATM software fleets, but with far more intelligence built in.

A Real-World Transformation Story

A regional bank operating across Southeast Asia struggled with slow ATM transactions and inconsistent KYC experiences due to variable connectivity. They introduced regional edge clusters connected to branch and ATM networks.

The results were striking. Average ATM transaction times dropped by more than half. KYC verification became faster and more consistent across countries. Network outages no longer brought branches to a halt. Compliance teams gained clearer data residency guarantees.

Most importantly, customer satisfaction scores for in-branch services increased without adding staff or expanding branch footprints.

A Practical 90-Day Path for Banks

In the first 30 days, banks should identify branch and ATM workflows where latency or outages directly affect customers. These are prime edge candidates.

In the next 30 days, deploy a limited edge pilot in a small set of branches or regions, focusing on ATM authorization, KYC pre-checks, or queue management.

In the final 30 days, integrate observability, security controls, and cloud synchronization, then expand gradually.

This is not a “big bang” transformation. It is an architectural evolution.

The Bigger Picture

The future branch is not just a physical location. It is a distributed computing environment that blends human service with machine intelligence.

Banks that treat branches and ATMs as passive endpoints will continue to struggle with latency, outages, and rising costs. Banks that treat them as edge platforms gain speed, resilience, compliance, and trust.

The branch of the future does not compete with digital banking. It complements it by bringing real-time intelligence back to the places where customers still value human presence.