Real-Time Fraud Detection at the Edge: How Banks Stop Threats in Milliseconds

Why moving fraud decisions closer to transactions changes outcomes, not just architecture.

The New Fraud Reality: Speed Beats Accuracy Alone

In fraud prevention, timing is everything.

A transaction approved in 40–70ms can stop a mule account before funds move.

The same decision made in 250–400ms often arrives after the damage is done.

Banks learned this the hard way as digital payments exploded. Cloud-only fraud stacks were accurate, but too slow. By the time a centralized model scored a transaction, downstream systems had already committed.

The shift: run fraud inference at the edge, where the transaction happens.

This is not about replacing the cloud. It is about putting milliseconds where they matter most.

1. Why Cloud-Only Fraud Detection Falls Short

A) Latency kills signal quality

Fraud signals decay fast:

- Velocity patterns change within seconds

- Device fingerprints lose value after retries

- Session context fragments across hops

A 300ms delay is not just slow. It is less accurate.

B) Network variability creates blind spots

Cloud routing depends on:

- Cross-region hops

- ISP congestion

- Peak-hour spikes

Fraud systems need predictable latency, not average latency.

C) Regulatory pressure favors local decisions

Many regulators now expect:

- Local processing of payment metadata

- Minimal cross-border sharing

- Explainable, auditable decisions

Edge deployments satisfy all three.

2. What “Fraud at the Edge” Really Means

Edge fraud detection does not mean training big models on small devices.

It means:

- Inference at the edge

- Training in the cloud

- Policy and orchestration across both

Typical split

- Cloud: feature engineering, model training, global risk analytics

- Edge: transaction scoring, rule enforcement, immediate actions

Think of the edge as a decision executor, not a data scientist.

3. Where Edge Fraud Delivers Immediate Wins

A) Card payments and UPI

- Sub-50ms scoring

- Local velocity checks

- Region-specific heuristics

B) ATM withdrawals

- Withdrawal amount thresholds

- Device health checks

- Geo consistency

C) Account takeovers

- Login anomaly detection

- Session hijack signals

- Device mismatch

D) Real-time lending

- Synthetic identity screening

- Behavioral risk scoring

- Instant approvals or step-up authentication

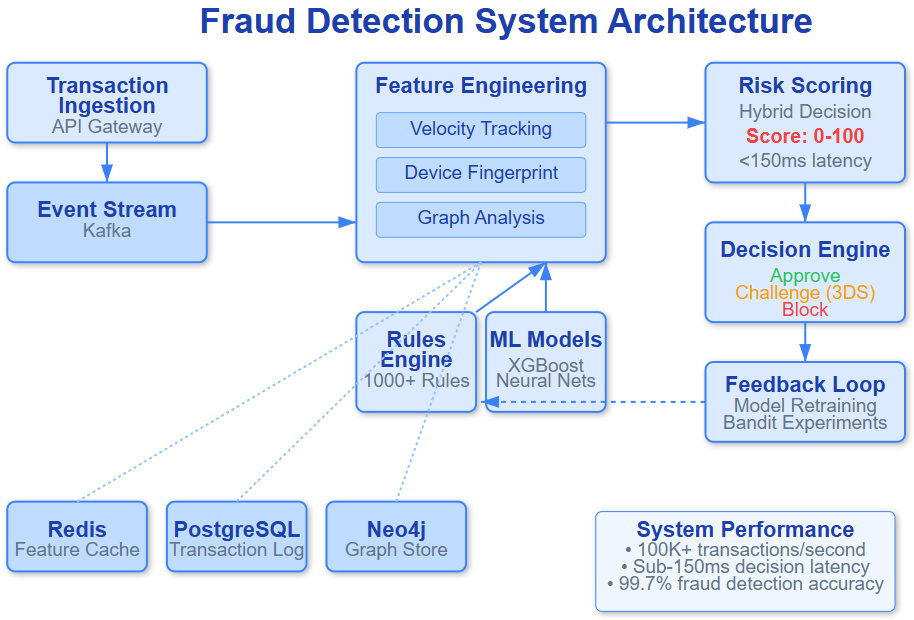

4. The Edge Fraud Architecture (Simplified

Step 1: Transaction hits edge

ATM, POS, mobile app, browser, or payment gateway.

Step 2: Local feature extraction

- Device fingerprint

- Velocity counters

- Geo proximity

- Historical risk cache

No cloud calls yet.

Step 3: ML inference at edge

A compact model scores risk in 5–20ms.

Step 4: Policy decision

- Approve

- Decline

- Step-up (OTP, biometric, delay)

Step 5: Async cloud sync

Edge sends:

- Decision metadata

- Feature summaries

- High-risk samples

Cloud updates global models later.

5. Models That Actually Work at the Edge

Edge fraud models must be:

✔ Small

✔ Deterministic

✔ Fast

✔ Interpretable

Common choices

- Gradient-boosted trees

- Logistic regression ensembles

- Small neural nets

- Rules + ML hybrids

Interesting fact:

Several Tier-1 banks report better outcomes with hybrid rules + small ML models at the edge than with large cloud-only deep models.

Why? Because speed and locality beat raw complexity.

6. A Real Bank Story: 72% Faster Decisions

A large APAC retail bank faced:

- 280ms average fraud decision time

- High false positives on peak days

- Rising UPI fraud attempts

What they changed

- Deployed fraud inference nodes at regional edges

- Cached velocity and device features locally

- Limited cloud calls to high-risk escalations

Results

- Decision time: 280ms → 78ms

- Fraud detection rate: +11%

- False positives: −18%

- Customer complaints: −22%

No model rewrite. Just architectural placement.

7. Handling Model Drift and Updates at the Edge

This is where many teams struggle.

Best practices

- Train centrally, deploy locally

- Version models like firmware

- Canary releases per region

- Automatic rollback on metric degradation

- Nightly drift reports

Edge nodes should never auto-update blindly.

8. Security and Trust at the Edge

Fraud systems are prime targets.

Edge security must include:

- Secure boot and signed models

- Encrypted inference artifacts

- Tamper detection

- mTLS between edge and cloud

- Local audit logs

Key rule:

If an attacker compromises an edge node, the blast radius must stay local.

9. Explainability and Compliance

Regulators increasingly ask:

“Why was this transaction declined?”

Edge fraud systems should produce:

- Feature-level explanations

- Rule hit summaries

- Confidence scores

These are sent to the cloud for:

- Audit trails

- Dispute resolution

- Regulatory reporting

Edge does not mean opaque.

10. Cost Benefits Most Teams Miss

Running fraud at the edge often reduces:

- Cloud inference costs by 40–60%

- Network egress significantly

- Peak-hour scaling stress

Edge nodes handle bursts naturally, without overprovisioning central systems.

11. 30-60-90 Day Adoption Plan

Days 0–30

- Identify top 3 fraud decision points

- Measure current p95 latency

- Select edge inference framework

Days 31–60

- Deploy one model to edge

- Add local feature caching

- Implement async cloud sync

Days 61–90

- Roll out to additional regions

- Introduce canary updates

- Add explainability pipelines

- Run fraud chaos tests

12. Common Pitfalls to Avoid

❌ Pushing full models to the edge

✔ Use compact inference models

❌ Treating edge as always online

✔ Design for intermittent sync

❌ Ignoring observability

✔ Track false positives, drift, latency locally

❌ Centralizing every decision

✔ Escalate only high-risk cases

Final Thought

Fraud prevention is a race against time.

Banks that rely solely on cloud analytics will always be reacting.

Banks that move decisions to the edge act first.

Edge-based fraud detection is not about being faster for the sake of speed.

It is about making the right decision before fraud becomes irreversible.